Become a part of the team and join the MCQ Markets journey today.

Total Amount Received

We have extensive connections in the motorsports industry, including an exclusive deal to acquire an Indy Car race team, a portion of which will be fractionalized on MCQ's platform. Our co-founder, hailing from a renowned racing family and owning a Porsche restoration house, brings invaluable expertise and passion to our endeavors.

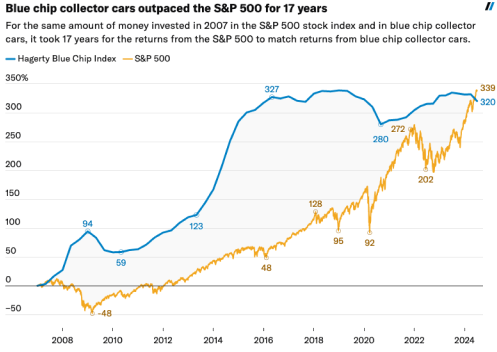

Learn MoreCollector cars are now seen as alternative investments, offering diversification beyond traditional assets. Many classic and collector cars have appreciated significantly, even amid economic turbulence, often surpassing traditional investments like stocks (S&P 500), Real Estate and even the Art Market.

The Global Collector Car market is substantial and growing. In 2021, it was valued at $31.6 billion and is projected to reach $51.5 billion by 20281.

In the United States, which holds the largest share of this market, revenue was $15 billion in 2020 and is expected to increase to $19B billion by 20242.

Majority of the S&P portfolios have not seen exponential growth like certain cars such as the Ferrari F40, which has had over 300% growth in a decade3.

During the 2008 financial crisis, the S&P lost 25% of its value whereas many collector cars retained or even gained value4. As demand for collector and limited-edition cars from iconic brands like Ferrari, Lamborghini, Porsche and Mercedes continue to rise, these vehicles are becoming increasingly complex to acquire. This scarcity adds to their allure and value, making them highly sought after assets.

Our brand's strength is further amplified by investment from numerous IndyCar and F1 drivers and other prominent racing influencers who proudly serve as our brand ambassadors. This extensive network not only bolsters our credibility but also significantly enhances our presence in the motorsport’s community.

A French driver for Juncos Hollinger Racing. Grosjean made 180 starts in Formula One.

IndyCar Driver Profile

IMSA WeatherTech SportsCar champion, and a two-time class winner at the Rolex 24

IndyCar Driver Profile

Illot has 36 starts with Juncos Hollinger Racing over the last three seasons.

IndyCar Driver Profile

Devlin competed in the IndyCar Series for Andretti Steinbrenner Autosport.

Wikipedia Driver Profile

MCQ Markets enables investments in luxury assets, providing an alternative to major auction houses and private car sales platforms.

Having been involved with over 50 public companies, that have raised billions for past projects, the MCQ Markets and its capital markets team is leveraging our extensive experience in North American public markets to open up a world of opportunities for potential investors.

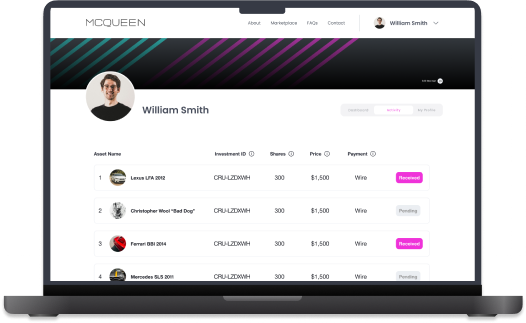

Create your account to get access and browse the investment opportunities and offerings.

After signup, you can access to all assets on our platform. Buy, Build, and creating your future.

Each share is initially valued at $20 and the minimum investment is $500 (25 shares) per asset.

Upon reaching investment term, assets will be sold via auction or private transaction.

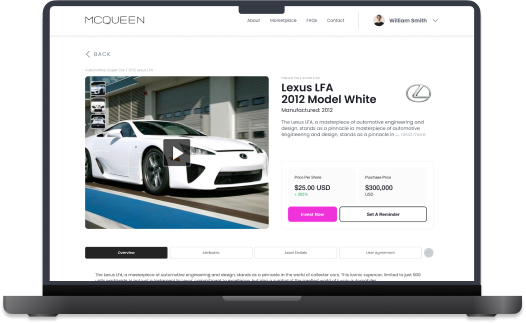

Designed by Leonardo Fioravanti. Among one of the last fully hand-built cars from Ferrari.

With an estimation of only 350 being built worldwide and approximately 132 built for the United States.

Our restoration project offerings are coming soon. Stay tuned for more details and exciting updates.

With MCQ Markets, invest in fractionalized luxury today for a wealthier tomorrow. Our platform is nearing the finish line, with an anticipated public launch in Q4 2024. We invite investors to join MCQ Markets on our journey by investing in our Regulation Crowdfunding offering.

We are currently selling shares at $5.40/share, with a minimum investment of $54. We encourage investors to review our Business Plan, Use of Proceeds and the related Risk Disclosures in our Form C offering statement.

We’re offering attractive incentives for investors, from time-based bonus shares to exclusive access to members only developments and events.

◦ Access to Marketplace pre-launch

◦ All Bronze level perks

◦ Exclusive MCQ Markets Launch Metal Keychain

◦ All Silver level perks

◦ Access to view and purchase at least one asset before its general (public) listing

◦ Invitation to the exclusive MCQ Markets launch party

◦ All Gold level perks

◦ IndyCar driver virtual meet and greet and signed memento

◦ All Platinum level perks

◦ Invite to a Race Day for you and a friend (meet & greet)

◦ Permanent VIP Access on MCQ Markets Platform (ie. access to cars at least one day before public launch)

Why invest in startups?

RegulationCF allows investors to invest in startups and early-growth companies. With RegulationCF Offerings, you aren’t buying products or merchandise - you are buying apiece of a company and helping it grow.

How much can I invest?

Accredited(high net worth) investors can invest as much as they want. But if you are NOTan accredited investor, your investment limit depends on either your annual income or net worth, whichever is greater. If the number is less than $124,000, you can only invest 5% of it. If both are greater than $124,000 then your investment limit is 10%.

How do I calculate my net worth?

To calculate your net worth, just add up all of your assets and subtract all of your liabilities (excluding the value of your primary residence). The resulting sum is your net worth.

What are the tax implications of an equity crowdfunding investment?

We cannot give tax advice, and we encourage you to talk with your accountant or tax advisor before making an investment.

Who can invest in a Regulation CF Offering?

Individuals over 18 years of age can invest subject to the investment limits identified above.

How do I get a return on my investment?

Investing in startups is risky and there is no guarantee you will get a return on your investment. If the value of the company grows, then you have a higher potential of making a profit on your investment which may materialize from the sale of the company, an IPO or other event.

What do I need to know about early-stage investing? Are these investments risky?

There will always be some risk involved when investing in a startup or small business. And the earlier you get in the more risk that is usually present. If a company goes out of business, your ownership interest could lose all value. You may also have limited voting power to direct the company due to dilution overtime. See disclosures and educational materials on the Issuance Express footer below and our risk disclosures in the Form C.

How does MCQ Markets choose which assets to acquire?

MCQ Markets sources assets exclusively from carefully vetted, reputable collectors. This selective approach ensures that each piece we acquire is part of a legacy of excellence, offering our clients exclusive access to the finest selections. MCQ Markets has a strong network of relationships with dealerships, auction houses, private collectors, media influencers as well as directly with certain manufacturers.The team will review the statistics on numerous cars, and cross reference to previous sales, condition of the vehicles for previous sales including, but not limited to the mileage on the car.

Why does MCQ Markets only offer Luxury or Collector Carson its Marketplace?

At present, MCQ Markets only offers shares in luxury and collector cars on its marketplace platform, but it may expand to include additional types of assets in the future. Our initial focus on these cars was due to several compelling reasons:

What does MCQ Markets charge buyers on its marketplace platform?

All fees associated with MCQ Markets are transparently disclosed to investors on the dedicated asset details page.

Can I list my Luxury or Collector Car for sale on MCQ Markets?

Asset owners interested in selling their assets are invited to contact our acquisitions team. This includes individual investors, luxury car owners, and institutional representatives. Please note that, we currently only consider luxury cars with minimum value of $500,000 for listing.

Who stores the assets that you sell shares in on the MCQ Marketplace Platform?

The specifics vary with each offering. Information regarding storage, and safeguarding is comprehensively outlined on the detail page of each asset.

Can I sell my shares?

The shares are not public shares and there is no immediate option to sell your shares. See the Disclosure link in the footer for more details on holding times and other restrictions.

What happens if a company does not reach their funding target?

If a company does not reach its minimum funding target, all funds will be returned to the investors after the close of the offering.

How can I learn more about a company's offering?

All available information is on this offering page and in the Form C offering documents which should be reviewed before making an investment.

What if I change my mind about investing?

You can cancel your investment at any time, for any reason, until 48 hours prior to when a escrow closing occurs after the minimum target is reached. See the Form C and Disclosure details (footer)for more information.

How do I keep up with how the company is doing?

Ata minimum, the company will be filing with the SEC and posting on its website an annual report, along with certified financial statements. Those should be available 120 days after the fiscal year end. If the company meets are porting exception, or eventually has to file more reported information to theSEC, the reporting described above may end. If these reports end, you may not continually have current financial information about the company.

When will I receive my shares?

Shares will be issued approximately 1 month after the fundraise closes.

What is Issuance Express?

Jumpstart Micro, Inc d.b.a. Issuance Express (“IssuanceExpress”) is a Funding Portal registered with the SEC and a member of FINRA.Under Regulation Crowdfunding, Issuance Express acts as an intermediary platform for Issuers (companies selling securities in compliance with the regulations) and Investors (individuals purchasing securities offered byIssuers). Issuance Express does not provide investment advice or make any investment recommendations to any persons, ever. Please see the disclosures page (footer) for more details.

What’s your share price?

$5.40

What is the minimum investment amount?

The minimum investment for this current round is $540.00

What kind of shares are you issuing?

The Series D Convertible Preferred Stock in this Offering may convert into the Common Stock of the Company in certain circumstances, including: (1) following an IPO in which the Company’s Common Stock is traded on a national stock exchange, or (2)upon a voluntary or involuntary liquidation of the Company. Upon the occurrence of one of those events, each share of Series D Convertible Preferred Stock will convert into 10 shares of the Company’s Common Stock.

How much are you raising?

We are currently raising up to $750k in this offering.

What is the current valuation of the company?

$49.87M, which was established by the Company based on current developments and market progress.

How will MCQ Markets. make money?

MCQ Markets will make money through fees that it charges via its online marketplace platform which includes an acquisition fee, an administrative fee and a share of the increase in valuation of the assets on the platform. Additional ways of earning income may be added in the future.

How do you plan to use the proceeds from this funding round?

The proceeds raised from this funding round will be used for working capital, marketing, general and administration, professional fees, development and offering costs to complete any regulatory applications for itsRegulation Financings and intended go-public offering and marketing related to its launch.

Have a question or comment for MCQ Markets Reg CF Offering? Use the chat below and one of our staff will reply as soon as we are able.