THE SECURITIES OFFERED INVOLVE A HIGH DEGREE OF RISK AND MAY RESULT IN THE LOSS OF YOUR ENTIRE INVESTMENT. ANY PERSON CONSIDERING THE PURCHASE OF THESE SECURITIES SHOULD BE AWARE OF THESE AND OTHER FACTORS SET FORTH IN THIS FORM C AND SHOULD CONSULT WITH HIS OR HER LEGAL, TAX AND FINANCIAL ADVISORS PRIOR TO MAKING AN INVESTMENT IN THE SECURITIES. THE SECURITIES SHOULD ONLY BE PURCHASED BY PERSONS WHO CAN AFFORD TO LOSE ALL OF THEIR INVESTMENT.

Risk Disclaimer

Risks Related to the Company's Business and Industry:

We have no operating history on which to base our performance, so our prospects must be considered in light of the risks that any new company faces.

We were incorporated under the laws of California on March 14, 2024. As a result, we lack a track record from which to assess our prospects and future performance. Our proposed operations are subject to all business risks associated with a new enterprise. The likelihood of our creation of a viable business must be considered in light of the problems, expenses, difficulties, complications, and delays frequently encountered in connection with the inception of a business, operation in a competitive industry, and the continued development of advertising, promotions, and a corresponding client base. We anticipate that our operating expenses will increase for the near future. There can be no assurances that we will ever operate profitably. You should consider the Company’s business, operations and prospects in light of the risks, expenses and challenges faced as an early-stage company.

The experience and skills of the board of directors, executive officers, and key employees are critical to the company’s success.

The Company is particularly reliant on key members of the Company’s founding team, Aaron Zeraldo and Warren Navarro, who are spearheading the inception of the Company as its executive officers.

The loss of Aaron Zeraldo, Warren Navarro, or any other member of the board of directors or executive officer could have a negative impact on the company’s business, financial condition, cash flow, and operating results.

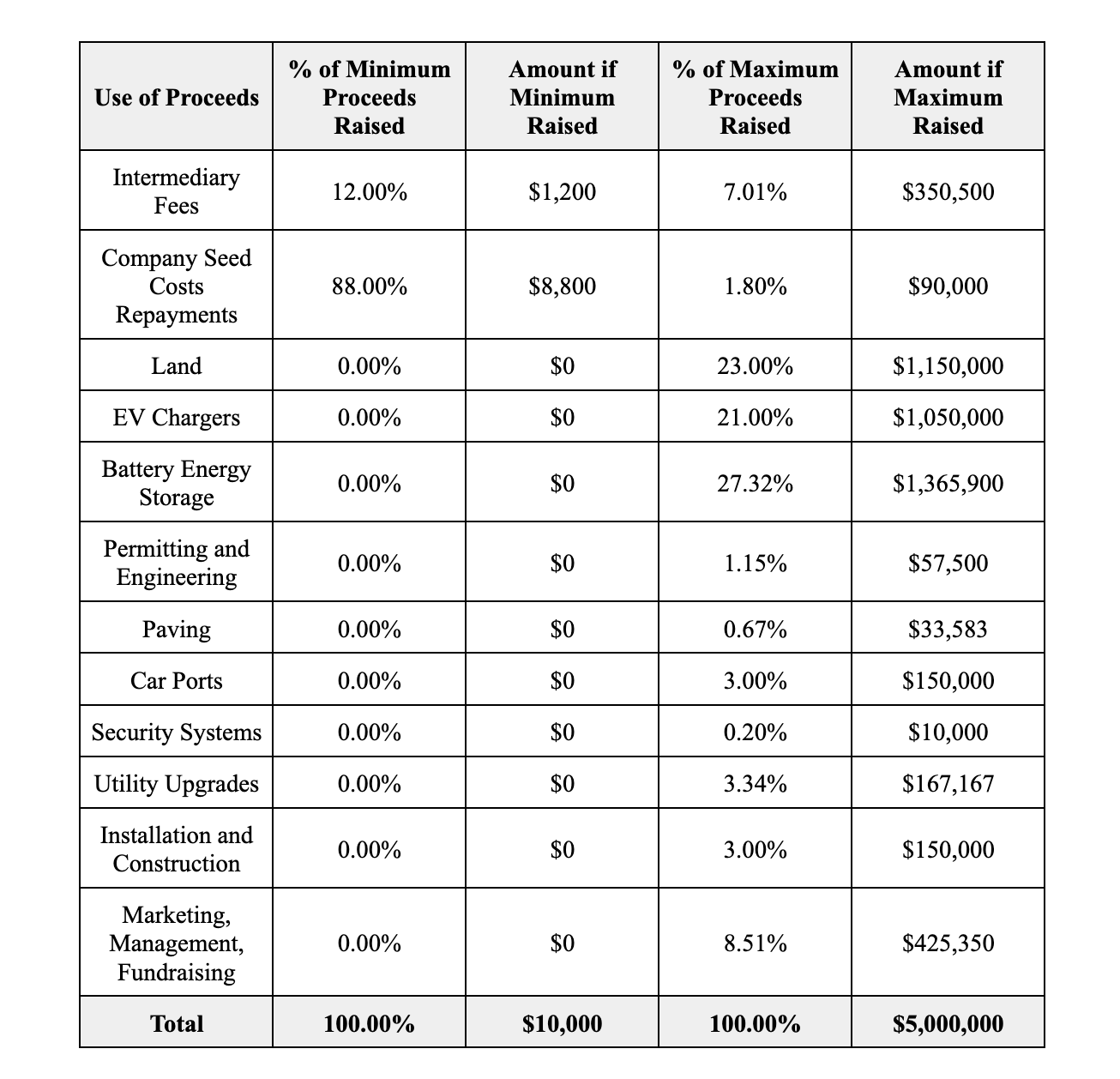

The amount of capital the Company is attempting to raise in this Offering is insufficient to fund the Company’s current operations.

In order to meet the Company’s short- and long-term objectives, funds other than those raised in the Offering will be required. There is no guarantee that the Company will be able to raise such funds on favorable terms, if at all. If we are unable to raise sufficient capital in the future, we will be unable to carry out our business plan, our continued operations will be jeopardized, and we may be forced to cease operations and sell or otherwise transfer all or substantially all of our remaining assets, causing an investor to lose all or a portion of his or her investment.

Despite its reliance on certain key personnel, the Company does not have any key man life insurance policies on any of these individuals.

The Company relies on Aaron Zeraldo and Warren Navarro to carry out its operations and business plan; however, the Company has not purchased any insurance policies covering those individuals in the event of their death or disability. As a result, if either Aaron Zeraldo or Warren Navarro dies or becomes disabled, the Company will not receive any compensation to cover their absence. The loss of such a person could have a negative impact on the Company’s operations.

In both the United States and various foreign jurisdictions, we are subject to income and non-income based taxes such as payroll, sales, use, value-added, net worth, property, and goods and services.

In order to determine our provision for income taxes and other tax liabilities, we must exercise significant judgment. In the ordinary course of our business, there are numerous transactions and calculations where the ultimate tax determination is unknown. Although we believe our tax estimates are reasonable, (i) there is no guarantee that the final determination of tax audits or tax disputes will not differ from what is reflected in our income tax provisions, expense amounts for non-income-based taxes, and accruals, and (ii) any material differences could have a negative impact on our financial position and operating results in the period or periods for which determination is made.

A pandemic, such as the coronavirus (COVID-19) outbreak, or other watershed events that can disrupt normal operations may have a material negative impact on the company’s business operations. If the disruptions posed by COVID-19 or other matters of global concern continue for an extended period of time, the company’s operations may be materially adversely affected.

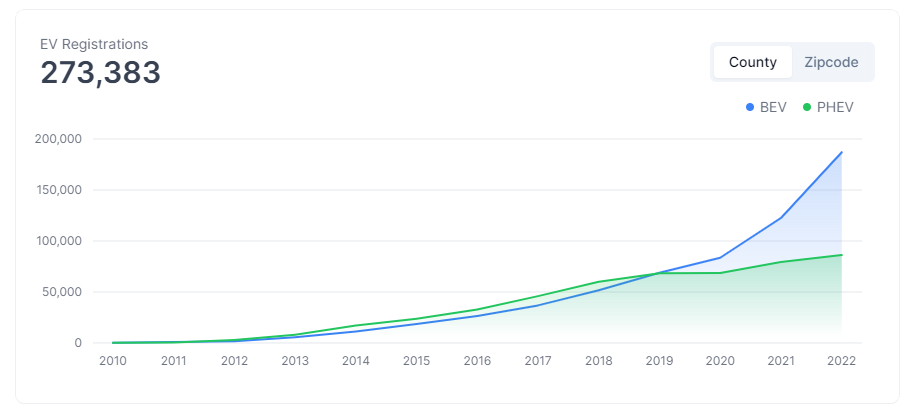

Our future cash flow is dependent on the performance of the operations located at 15555 San Fernando Blvd., Mission Hills, CA. and the adoption of electric vehicles in California. The California Air Resources Board (CARB) in August 2022 approved a landmark plan to end the sale of gasoline-only vehicles in the state by 2035 and set yearly, rising requirements for zero-emission vehicles, starting in 2026. We are subject to the risk of external adoption of new transportation technologies. The property is reliant on external EV drivers utilizing the operations, and a change in market conditions may lead to underperformance.

Under unfavorable general economic conditions, such as poor consumer sentiment, inflation, inclement weather, or natural disaster, there is no guarantee that our sales and financial performance will not suffer, which could have a negative impact on our revenues.

We are subject to risks that affect the retail environment, including adverse weather conditions and natural disasters, which could negatively affect consumer spending and adversely affect the sales of our retail tenants.

This could have an unfavorable effect on our operations and our ability to attract new retail tenants. For example, frequent or unusually intense inclement weather or natural disasters could prevent customers from reaching our tenants, reducing their profitability and harming our business. Similarly non-seasonal weather could inhibit our tenant’s ability to determine consumer demand, reducing their profitability and harming our business.

Our business operations are susceptible to, and could be significantly affected by, adverse weather conditions and natural disasters that could cause significant damage to our properties.

Although we intend to obtain insurance for our properties, our insurance may not be adequate to cover business interruption or losses resulting from adverse weather or natural disasters. In addition, our insurance policies may include substantial self-insurance portions and significant deductibles and co-payments for such events, and recent hurricanes in the United States have affected the availability and price of such insurance. As a result, we may incur significant costs in the event of adverse weather conditions and natural disasters. If we experience a loss that is uninsured or which exceeds our policy limits, we could incur significant costs and lose the capital invested in the damaged properties, as well as the anticipated future cash flows from those properties. In addition, if the damaged properties are subject to recourse indebtedness, we would continue to be liable for the indebtedness, even if these properties were irreparably damaged. In addition, certain of our properties may not be able to be rebuilt to their existing height or size at their existing location under current land-use laws and policies. In the event that we experience a substantial or comprehensive loss of one of our properties, we may not be able to rebuild such property to its existing specifications and otherwise may have to upgrade such property to meet current code requirements.

General economic conditions could have an adverse effect on our business and results of operations.

Our business is sensitive to general economic conditions, both nationally and locally, as well as international economic conditions. General poor economic conditions and the resulting effect of non-existent or slow rates of growth in the markets in which we operate could have an adverse effect on the demand for our real estate business. These poor economic conditions include higher unemployment, inflation, deflation, increased commodity costs, decreases in consumer demand, changes in buying patterns, a weakened dollar, higher transportation and fuel costs, higher consumer debt levels, higher tax rates and other changes in tax laws or other economic factors that may affect commercial and residential real estate. Specifically, high national or regional unemployment may arrest or delay any significant recovery of the residential real estate markets in which we operate, which could adversely affect the demand for our real estate assets.

Uninsured losses may adversely affect our business.

We, or in certain instances, tenants of our properties, carry property and liability insurance policies with respect to the properties. This coverage has policy specifications and insured limits customarily carried for similar properties. However, certain types of losses (such as from earthquakes and floods) may be either uninsurable or not economically insurable. Further, certain properties are located in areas that are subject to earthquake activity and floods. Should a property sustain damage as a result of an earthquake or flood, we may incur losses due to insurance deductibles, co-payments on insured losses or uninsured losses. Should an uninsured loss occur, we could lose some or all of our capital investment, cash flow and anticipated profits related to one or more properties. This could have an adverse effect on our business and results of operations.

The sale of the Property has not been consummated and our investment in the Property has not been finalized.

The seller has executed an agreement to sell the Property to the new owner/operator, however the transaction has not closed and may fail to do so for a number of unforeseen reasons. If the sale does not take place, our investment in the Property located at 15555 San Fernando Mission Blvd. Mission Hills, CA 91345, USA will not be accepted and the proceeds from this Offering will be reallocated to acquiring a new location for the business operations of the Company.

The Securities represent an investment in a single type of property in a single geographic location, and are not a diversified investment. To date, we have not generated revenue and do not foresee generating any revenue in the near future.

We are a startup Company and our business model currently focuses on planning/design, pre-construction, procurement, construction, and planning for post-construction requirements to bring the company to operational status for the general public, rather than generating revenue. While we intend to generate revenue in the future, we cannot assure you when or if we will be successful in doing so. We rely on external financing to fund our operations. We anticipate, based on our current proposed plans and assumptions relating to our operations (including the timetable of, and costs associated with our business) that, if the Minimum Amount is raised in this Offering, it will be sufficient to satisfy our contemplated cash requirements through approximately. If the sum of the investment commitments does not equal or exceed the minimum target offering amount at the offering deadline, no securities will be sold in the offering, investment commitments will be cancelled and committed funds will be returned assuming that we do not accelerate the development of other opportunities available to us, engage in an extraordinary transaction or otherwise face unexpected events, costs or contingencies, any of which could affect our cash requirements.

The Company has indicated that it may engage in certain transactions with related persons.

Please see the section of this Form C entitled “Transactions with Related Persons” for further details.

Risks Related to the Offering and Securities:

The Shares of Common Stock will not be freely tradable until one year from the initial purchase date. Although the Shares of Common Stock may be tradable under federal securities law, state securities regulations may apply and each Purchaser should consult with his or her attorney.

You should be aware of the long-term nature of this investment. There is not now and likely will not be a public market for the Shares of Common Stock. Because the Shares of Common Stock have not been registered under the Securities Act or under the securities laws of any state or non-United States jurisdiction, the Shares of Common Stock have transfer restrictions and cannot be resold in the United States except pursuant to Rule 501 of Regulation CF. It is not currently contemplated that registration under the Securities Act or other securities laws will be effected. Limitations on the transfer of the Shares of Common Stock may also adversely affect the price that you might be able to obtain for the Shares of Common Stock in a private sale. Purchasers should be aware of the long-term nature of their investment in the Company. Each Purchaser in this Offering will be required to represent that it is purchasing the Securities for its own account, for investment purposes and not with a view to resale or distribution thereof.

Neither the Offering nor the Securities have been registered under federal or state securities laws, leading to an absence of certain regulation applicable to the Company.

No governmental agency has reviewed or passed upon this Offering, the Company or any Securities of the Company. The Company also has relied on exemptions from securities registration requirements under applicable state securities laws. Investors in the Company, therefore, will not receive any of the benefits that such registration would otherwise provide. Prospective investors must therefore assess the adequacy of disclosure and the fairness of the terms of this Offering on their own or in conjunction with their personal advisors.

No Guarantee of Return on Investment

There is no assurance that a Purchaser will realize a return on its investment or that it will not lose its entire investment. For this reason, each Purchaser should read the Form C and all Exhibits carefully and should consult with its own attorney and business advisor prior to making any investment decision.

A majority of the Company is owned by a small number of owners.

Prior to the Offering the Company’s current owners of 20% or more beneficially own up to 100.0% of the Company. Subject to any fiduciary duties owed to our other owners or investors under California law, these owners may be able to exercise significant influence over matters requiring owner approval, including the election of directors or managers and approval of significant Company transactions, and will have significant control over the Company’s management and policies. Some of these persons may have interests that are different from yours. For example, these owners may support proposals and actions with which you may disagree. The concentration of ownership could delay or prevent a change in control of the Company or otherwise discourage a potential acquirer from attempting to obtain control of the Company, which in turn could reduce the price potential investors are willing to pay for the Company. In addition, these owners could use their voting influence to maintain the Company’s existing management, delay or prevent changes in control of the Company, or support or reject other management and board proposals that are subject to owner approval.

The Company has the right to extend the Offering deadline.

The Company may extend the Offering deadline beyond what is currently stated herein. This means that your investment may continue to be held in escrow while the Company attempts to raise the Minimum Amount even after the Offering deadline stated herein is reached. Your investment will not be accruing interest during this time and will simply be held until such time as the new Offering deadline is reached without the Company receiving the Minimum Amount, at which time it will be returned to you without interest or deduction, or the Company receives the Minimum Amount, at which time it will be released to the Company to be used as set forth herein. Upon or shortly after release of such funds to the Company, the Securities will be issued and distributed to you.

The Company has the right to end the Offering early.

The Company may also end the Offering early. If the Offering reaches the Minimum Amount after 30 calendar days but before the Offering deadline, the Company can end the Offering with five business days’ notice. This means your failure to participate in the Offering in a timely manner, may prevent you from being able to participate – it also means the Company may limit the amount of capital it can raise during the Offering by ending it early.

There is no present market for the Securities and we have arbitrarily set the price.

We have arbitrarily set the price of the Securities with reference to the general status of the securities market and other relevant factors. The Offering price for the Securities should not be considered an indication of the actual value of the Securities and is not based on our net worth or prior earnings. We cannot assure you that the Securities could be resold by you at the Offering price or at any other price.

Your ownership of the shares of stock will be subject to dilution.

Owners of do not have preemptive rights. If the Company conducts subsequent Offerings of or Securities convertible into , issues shares pursuant to a compensation or distribution reinvestment plan or otherwise issues additional shares, investors who purchase shares in this Offering who do not participate in those other stock issuances will experience dilution in their percentage ownership of the Company’s outstanding shares. Furthermore, shareholders may experience a dilution in the value of their shares depending on the terms and pricing of any future share issuances (including the shares being sold in this Offering) and the value of the Company’s assets at the time of issuance.

The Securities will be equity interests in the Company and will not constitute indebtedness.

The Securities will rank junior to all existing and future indebtedness and other non-equity claims on the Company with respect to assets available to satisfy claims on the Company, including in a liquidation of the Company. Additionally, unlike indebtedness, for which principal and interest would customarily be payable on specified due dates, there will be no specified payments of dividends with respect to the Securities and dividends are payable only if, when and as authorized and declared by the Company and depend on, among other matters, the Company’s historical and projected results of operations, liquidity, cash flows, capital levels, financial condition, debt service requirements and other cash needs, financing covenants, applicable state law, federal and state regulatory prohibitions and other restrictions and any other factors the Company’s board of directors deems relevant at the time. In addition, the terms of the Securities will not limit the amount of debt or other obligations the Company may incur in the future. Accordingly, the Company may incur substantial amounts of additional debt and other obligations that will rank senior to the Securities.

There can be no assurance that we will ever provide liquidity to Purchasers through either a sale of the Company or a registration of the Securities.

There can be no assurance that any form of merger, combination, or sale of the Company will take place, or that any merger, combination, or sale would provide liquidity for Purchasers. Furthermore, we may be unable to register the Securities for resale by Purchasers for legal, commercial, regulatory, market-related or other reasons. In the event that we are unable to effect a registration, Purchasers could be unable to sell their Securities unless an exemption from registration is available.

The Company has the right to conduct multiple “rolling” closings during The Offering.

If the Company meets certain terms and conditions an intermediate close of the Offering can occur, which will allow the Company to draw down on the proceeds of the Offering committed and captured during the relevant period. The Company intends to engage in rolling closings after the Minimum Offering Amount and other conditions are met. Investors should be mindful that this means they can make multiple investment commitments in the Offering, which may be subject to different cancellation rights. For example, if an intermediate close occurs and later a material change occurs as the Offering continues, Investors previously closed upon will not have the right to re-confirm or withdraw their investment as it will be deemed completed. In addition, our initial closings will cover the tranches of shares with lower purchase prices, so as we conduct rolling closings, your ability to purchase shares at purchase price will be reduced and you may be required to pay a higher price for the Securities you elect to purchase.

The Securities in this Offering are Non-Voting and have no protective provisions.

The Securities in this Offering are non-voting and have no protective provisions. As such, you will not be afforded protection, by any provision of the Securities or as a stockholder, in the event of a transaction that may adversely affect you, including a reorganization, restructuring, merger or other similar transaction involving the Company. If there is a “liquidation event,” or “change of control” for the Company, the Securities being offered do not provide you with any protection. In addition, there are no provisions attached to the Securities in the Offering that would permit you to require the Company to repurchase the Securities in the event of a takeover, recapitalization or similar transaction involving the Company.

In addition to the risks listed above, businesses are often subject to risks not foreseen or fully appreciated by the management. It is not possible to foresee all risks that may affect us. Moreover, the Company cannot predict whether the Company will successfully effectuate the Company’s current business plan. Each prospective Purchaser is encouraged to carefully analyze the risks and merits of an investment in the Securities and should take into consideration when making such analysis, among other, the Risk Factors discussed above.